Now is your last chance to take advantage of the 30% solar Investment Tax Credit (ITC), which is set to step down by the end of 2019. An unprecedented number of homeowners are going solar to maximize their return on investment. As a result, solar companies now have fewer availability on their schedules.

As of September 11th, 2019, Clean Solar has a few openings at 30% before filling the schedule for next year’s 26%. We cater to homes and businesses in the Bay Area, with a full team of professionals to ensure you get a quality solar system.

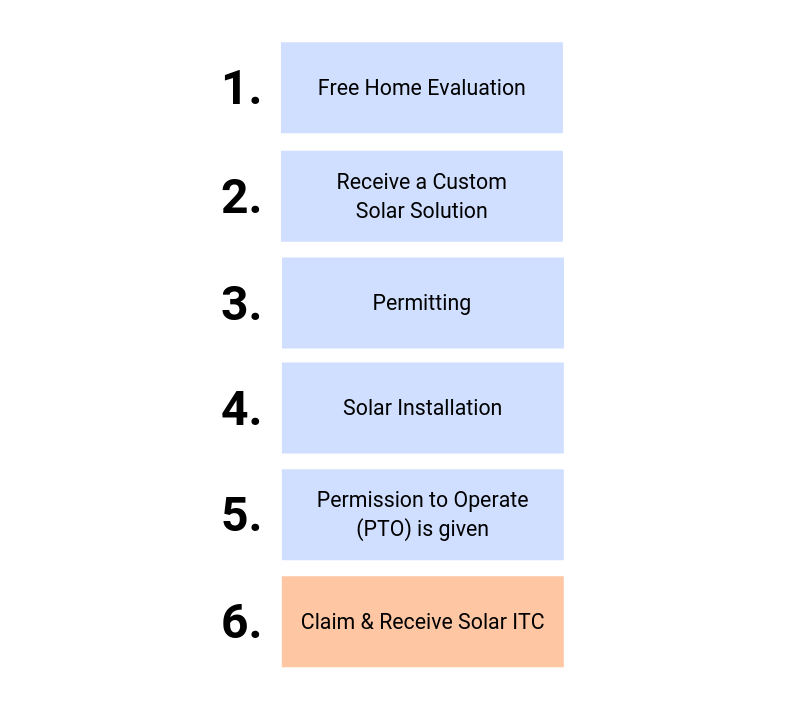

Clean Solar’s Solar Installation Process & Claiming ITC.

At Clean Solar, we make the solar installation process as efficient as possible. Our team takes care of all the design, permit and installation plans of your solar system. The entire process is 6-10 weeks on average. The actual installation of your solar system is 1-3 days. Here are more details:

What’s Solar ITC’s Future?

The Federal Tax Credit will be available through 2021, but the percentages will be dropping exponentially. Here’s the forecast:

2016-2019: The Solar Investment Tax Credit remains at 30% for both residential and commercial solar systems.

2020: The Solar ITC will drop to 26% for both residential and commercial solar system.

2021: The Solar ITC will continue to drop to 22% for both residential and commercial solar systems.

2022 and beyond: Commercial Solar Systems can deduct 10%, but residential owners will no longer have the solar tax credit.