Cutting down costs on your electricity bill and reducing your carbon footprint are among the leading reasons consumers have decided to go solar. Homeowners are more aware of the benefits of going solar and there’s never been a better time to invest. Whether your motivations to go solar are economic or environmental, here are some reasons you should consider, or reconsider, investing in solar and solar batteries this year.

Get rid of your electricity bill

This past year has been a big year for solar and solar storage batteries. Purchasing a solar battery alongside you solar panels today can help sustain power in your household during power outages and blackouts. Load shifting technology allows customers to store their excess energy from their solar system and use it during times of the day when rates are higher. Batteries allow for customers to use even more solar energy directly. Installing both a solar system and solar battery into your home could help to eliminate your electricity bill. Not to mention, secure your home against power outages and blackouts. Talk to a Clean Solar representative today to receive a quote and find out what solar system and battery is right for your household.

Fight against the rising cost of energy

By investing in a solar system now, you can decrease your electricity bill and protect yourself from unpredictable increases. In the past years, residential electricity has gone up on average three percent per year and is only going to continue to rise. By investing in solar, you are taking unpredictable energy increases into your own hands. This is a great investment for anyone who wants to protect themselves from any changes in energy prices and tariffs in the near future.

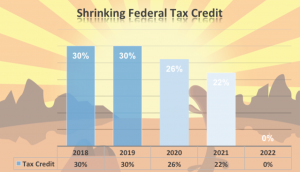

Tax credits are not going to be here much longer

Now is the best time to take advantage of the 30% Federal Tax Credit of your solar installation cost. The 30% credit will decrease in 2019, and we predict a large number of homeowners wanting to take advantage of this before it goes away. The federal solar tax credit, also known as the investment tax credit (ITC), allows you to deduct 30 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no cap on its value.

If you’re reading this and haven’t gone solar yet, don’t worry you still have a chance to take advantage of this huge tax savings. After 2019, the tax saving with reduce to 26% and then, 22% the following year. This tax saving will then be diminished for residential customers after 2021. Don’t wait any longer to consider getting solar and lose on all the additional savings.

Save the world one solar panel at a time

Taking care of our planet is crucial. Carbon emissions continue to rise, making there no better time to reduce your carbon footprint. Buildings contribute to 39% of all carbon emissions in the United States. Going solar can help decrease these effects. The electricity produced from solar panels is completely emissions free. In contrast, most utility companies are still reliant on fossil fuels like coal to produce energy. A typical residential solar system can omit three to four tons of carbon emissions each year. That’s the equivalent of planting over 100 trees per year. The impact of your decision to go solar could certainly make a significant difference.